Description

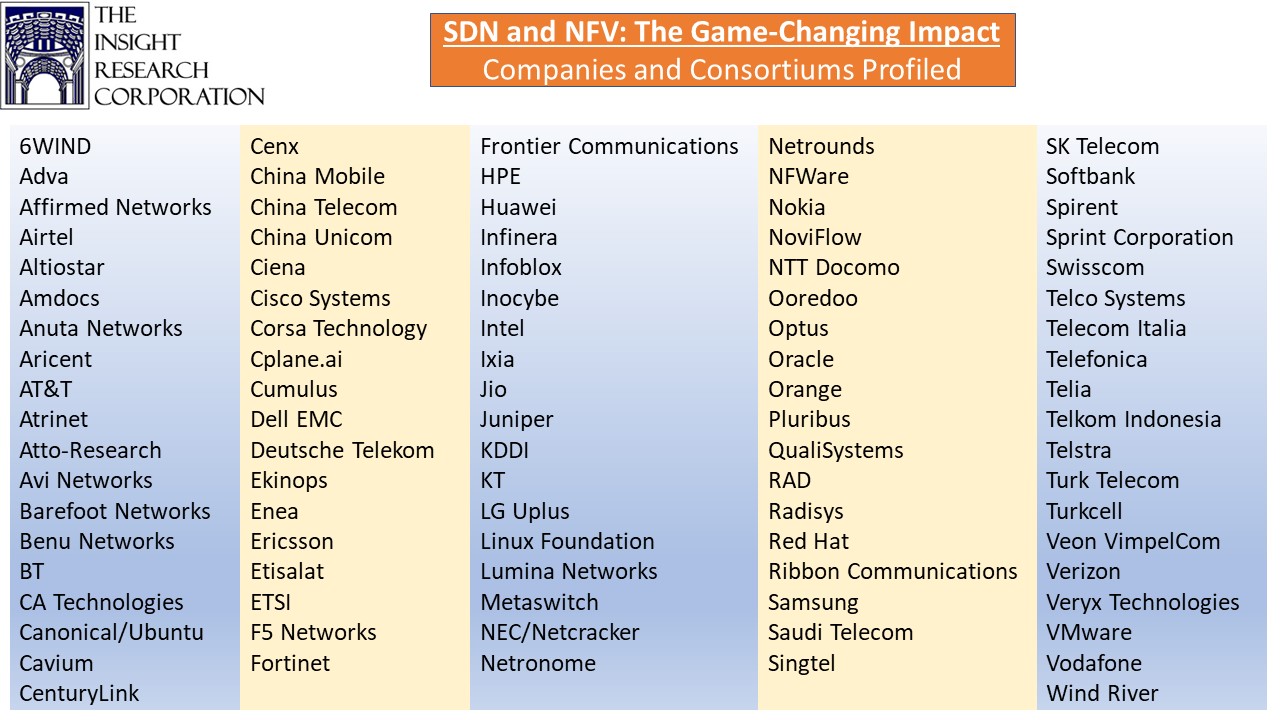

Software-defined networking (SDN) and network function virtualization (NFV) promise to rewrite the rules of network design, engineering, configuration and management. Their impact is being felt across the stakeholder spectrum from OEMs to telecom operators. The number of companies associated with NFV and SDN is already in three digits. What are SDN and NFV? At the risk of oversimplifying things, it can be said that SDN decouples the control and forwarding functions, and NFV heralds the advent of virtualization in the network equipment space. At individual vendor level, there is considerable heterogeneity about what SDN and NFV entail, and their interrelationship. There are a few clear pointers though. Telcos are cautiously optimistic that NFV and SDN will facilitate their ascent into services and solutions with better profitability potential. NFV and SDN also democratize the network equipment manufacturing landscape to an extent, by opening the door wider for ISVs. Predictably, network equipment OEMs are proactively attempting to embellish their portfolios with NFV and SDN offerings.

This report is a result of extensive primary and secondary research spanning a cross-section of the industry. It will be an invaluable resource for telcos, OEMs, ODMs, ISVs, data centers, enterprises and investors with anything at stake in NFV and SDN.

Highlights

This report will answer the following questions in the context of NFV and SDN:

- What are the direct and indirect revenue opportunities?

- How large is the NFV market? What are its hardware, software and service components?

- How large is the SDN market? What are its hardware, software and service components?

- What are the key geographical trends to look out for?

- Who are thought leaders? How do they influence implementation methodologies?

- Who are the key players? What are their initiatives and the implications of these initiatives?

- How similar are they, and how different?

- What are the motivations behind their development?

- Who are their principal champions?

This report will answer these questions and also present a threadbare qualitative and quantitative implications of SDN and NFV for telecom products and services.

Scope

Table of Contents

1 Executive Summary

1.1 Salient quantitative observations

1.2 Drivers for SDN and NFV

1.2.1 Service agility

1.2.2 Centralized control

1.2.3 Enhanced reliability

1.2.4 Software-driven approach

1.2.5 Cost savings

1.2.6 Vendor neutral hardware

1.2.7 Optimal utilization of resources

1.2.8 Flexibility in network design

1.2.9 Benign effect on capital and operating expenditure

1.2.10 Ownership of feature-rich services

1.2.11 Takeaways for telcos from SDN and NFV

2 Software-Defined Networking

2.1 Introduction and evolution

2.1.1 Role played by industry consortiums

2.2 SDN architecture

2.2.1 Application layer

2.2.2 Control layer

2.2.2.1 The OpenDaylight (ODL) SDN platform

2.2.2.2 The OpenContrail SDN platform

2.2.2.2.1 OpenContrail architecture

2.2.2.2.2 Compute node

2.2.2.2.3 Control plane

2.2.2.2.4 Configuration nodes

2.2.2.2.5 Analytics node

2.2.2.2.6 REST APIs

2.2.2.2.7 OpenStack

2.2.2.3 Open Network Operating System (ONOS)

2.2.3 Infrastructure layer

2.3 SDN interfaces

2.3.1 Northbound interfaces

2.3.1.1 REST

2.3.1.2 Java

2.3.2 Southbound interfaces

2.3.2.1 OpenFlow

2.3.2.2 OVSDB

2.3.2.3 Netconf

2.3.2.4 YANG and others

2.4 SDN use-cases

2.5 SDN use-case: Central Office Re-architected as a Datacenter (CORD)

2.5.1 Traction among telcos

2.6 SDN use-Case: Service Delivery/Fulfillment, excluding BoD

2.6.1 Nuage Networks Virtualized Services Platform (VSP)

2.7 SDN use-case: Network-as-a-Service (NaaS)/ Bandwidth on Demand (BoD)

2.7.1 Infinera Xceed

2.7.2 HPE Carrier SDN

2.8 SDN use-case: Mobile network virtualization/Network slicing

2.8.1 Affirmed Networks Virtual Slice Selection Function (vSSF)

2.9 SDN use-case: SD-WAN

2.9.1 Versa SD-WAN solution

2.9.1.1 Versa Director

2.9.1.2 Flex VNF

2.9.2 NEC/Netcracker SDN controllers

2.1 SDN Use-Case: Service function chaining

2.10.1 Benu VSE

2.11 Multifunction SDN controller

2.11.1 Adva Ensemble

3 Network Functions Virtualization

3.1 Introduction and evolution

3.2 Role played by European Telecommunications Standards Institute (ETSI)

3.3 NFV architecture

3.3.1 VNFI

3.3.2 Managing NFVi performance

3.3.3 Hypervisors – vSphere, KVM and others

3.3.4 DPDK – Accelerating the processors

3.3.5 Fast Data Input / Output (FD.io) – an Able Ally for DPDK

3.3.6 Containers – Contrarians to VMs

3.3.7 VNFs

3.3.8 MANO

3.3.8.1 Virtualized Infrastructure Manager (VIM)

3.3.8.1.1 Kubernetes

3.3.8.2 VNF Manager (VNFM)

3.3.8.3 NFV Orchestrator (NFVO)

3.3.8.4 Open Network Application Platform (ONAP)

3.3.8.5 Lifecycle Services Orchestrator – The contrarian MANO

3.3.9 Parallels with server virtualization

3.4 VNF use-cases

3.5 VNF use-case: Switching and routing VNFs

3.5.1 vADC/vLB/vWOC VNF – NFWare vADC

3.5.2 vADC/vLB/vWOC VNF – Avi-Vantage Platform

3.5.3 vRouter/vCGNAT/vIPSec/vVPN VNF – Juniper vMX CG Router

3.5.4 vRouter/vCGNAT/vIPSec/vVPN VNF – NFWare vCGNAT

3.5.5 vSwitch VNF – Huawei CE 1800 vSwitch

3.6 VNF use-case: Core WAN VNFs

3.6.1 vIMS/vCSC/vPCRF VNF – Metaswitch Clearwater IMS Core

3.6.2 vBBU/vRAN/xRAN VNF – Altiostar vRAN

3.6.3 vEPC/vVoLTE VNF – Nokia VoLTE

3.6.4 vEPC/vVoLTE VNF – Samsung AdaptiV

3.6.5 vEPC/vVoLTE VNF – Affirmed Networks MCC

3.7 VNF use-case: Interface and gateway VNFs

3.7.1 vAMS/vSBC/vWebRTC GW VNF – Metaswitch Perimeta SBC

3.7.2 vCPE/vSG VNF – Huawei USG6000V vSG

3.7.3 vWAG VNF – Genband NFV (vWAG)

3.8 VNF use-case: Standard and security device VNFs

3.8.1 vDNS VNF – Infoblox Virtual Secure DNS

3.8.2 VFirewall VNF – Fortinet FortiGate VM

3.8.3 vFirewall VNF – Fortinet FortiGate VMX

3.8.4 vIPSec/vVPN VNF – 6WIND Turbo IPsec

3.9 VNF use-case: IP application VNFs

3.9.1 vIM VNF – Genband NFV (vIM)

3.9.2 vVoIP VNF – Mushroom Networks VoIP Armor

3.10 VNF use-case: Testing VNFs

3.10.1 vProbe/vTA VNF – Netrounds vTA

3.10.2 vProbe/vTA VNF – Enea Qosmos NFV Probe

3.10.3 vProbe/vTA VNF – Ixia IxNetwork VE

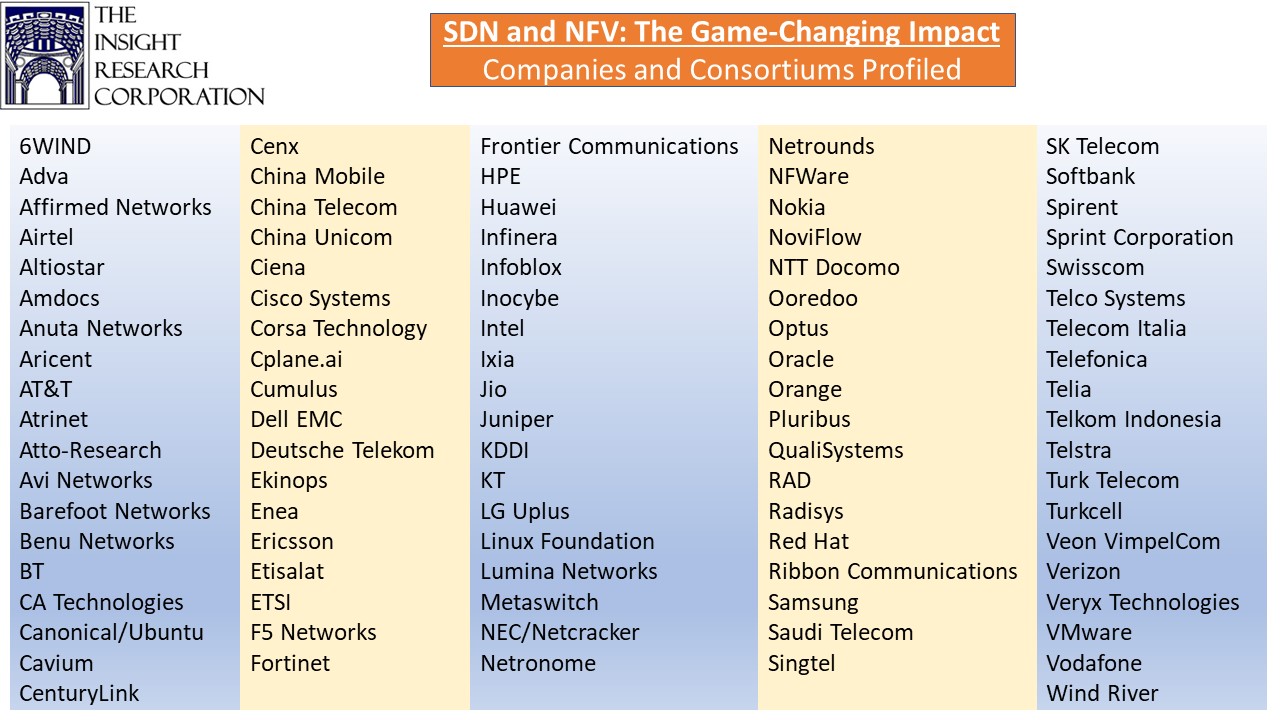

4 Solution Provider Profiles

4.1 Overview of the Market

4.1.1 Possibilities of rebranding existing solutions as NFV and SDN-enabled

4.1.2 Non-agreement about the extent of mutual dependence of SDN and NFV

4.1.3 Addressing challenges associated with NFV and SDN

4.2 Organization categories

4.2.1 Equipment vendors

4.2.2 Independent software vendors

4.2.3 Semiconductor specialists

4.2.4 OS and firmware specialists

4.2.5 Niche solution developers

4.3 6WIND

4.3.1 SDN and NFV initiatives

4.3.1.1 6WINDGate

4.3.1.2 6WIND Virtual Accelerator

4.3.1.3 6WIND Turbo Router

4.3.1.4 6WIND Turbo IPsec

4.3.2 Analysis

4.4 Adva

4.4.1 SDN and NFV initiatives

4.4.1.1 Ensemble

4.4.2 Analysis

4.5 Affirmed Networks

4.5.1 SDN and NFV initiatives

4.5.1.1 Affirmed Networks Mobile Content Cloud (MCC)

4.5.1.2 Affirmed Networks Virtual Slice Selection Function (vSSF)

4.5.2 Analysis

4.6 Altiostar

4.6.1 SDN and NFV initiatives

4.6.1.1 Altiostar vRAN

4.6.2 Analysis

4.7 Amdocs

4.7.1 SDN and NFV initiatives

4.7.1.1 Network Cloud Service Orchestrator (NSCO)

4.7.2 Analysis

4.8 Anuta Networks

4.8.1 SDN and NFV initiatives

4.8.1.1 Anuta NCX

4.8.2 Analysis

4.9 Aricent

4.9.1 SDN and NFV initiatives

4.9.1.1 VNF Manager

4.9.2 Analysis

4.10 Atrinet

4.10.1 SDN and NFV initiatives

4.10.2 Analysis

4.11 Atto-Research

4.11.1 SDN and NFV initiatives

4.11.1.1 Athene

4.11.1.2 OBelle

4.11.2 Analysis

4.12 Avi Networks

4.12.1 SDN and NFV initiatives

4.12.1.1 Avi-Vantage Platform

4.12.2 Analysis

4.13 Barefoot Networks

4.13.1 SDN and NFV initiatives

4.13.1.1 Barefoot Tofino

4.13.2 Analysis

4.14 Benu Networks

4.14.1 SDN and NFV initiatives

4.14.1.1 Benu VSE

4.14.2 Analysis

4.15 CA Technologies

4.15.1 SDN and NFV initiatives

4.15.1.1 CA Technologies Virtual Network Assurance (VNA)

4.15.2 Analysis

4.16 Canonical/Ubuntu

4.16.1 SDN and NFV initiatives

4.16.1.1 Canonical OpenStack

4.16.2 Analysis

4.17 Cavium

4.17.1 SDN and NFV initiatives

4.17.1.1 ThunderX ARMv8 Processors

4.17.1.2 OCTEON TX ARMv8 SoCs

4.17.1.3 XPliant Programmable SDN Ethernet Switches

4.17.1.4 LiquidIO Fully Programmable Network Adapters

4.17.1.5 FastLinQ Network Adapters

4.17.2 Analysis

4.18 Cenx

4.18.1 SDN and NFV initiatives

4.18.1.1 CENX 7

4.18.2 Analysis

4.19 Ciena

4.19.1 SDN and NFV initiatives

4.19.1.1 Blue Planet SDN/NFV Orchestrator

4.19.2 Analysis

4.20 Cisco Systems

4.20.1 SDN and NFV initiatives

4.20.1.1 Cisco ASAv (Adaptive Security Virtual Appliance)

4.20.1.2 Cisco Nexus 1000V Virtual Switch

4.20.1.3 Cisco Cloud Services Router CSR 1000V

4.20.1.4 Cisco NFV Infrastructure (NFVI)

4.20.1.5 Cisco Application Centric Infrastructure (ACI) – SDN for datacenters.

4.20.1.6 Network Services Orchestrator

4.20.1.7 Virtual Managed Services (VMS)

4.20.2 Analysis

4.21 Corsa Technology

4.21.1 SDN and NFV initiatives

4.21.1.1 Corsa 10G/100G SDN Switches

4.21.2 Analysis

4.22 Cplane.ai

4.22.1 SDN and NFV initiatives

4.22.1.1 Multi-Suite Manager (MSM)

4.22.1.2 Overlay Gateway Router (OGR)

4.22.1.3 Dynamic Virtual Networks (DVN)

4.22.2 Analysis

4.23 Cumulus

4.23.1 SDN and NFV initiatives

4.23.1.1 Cumulus Linux

4.23.2 Analysis

4.24 Dell EMC

4.24.1 SDN and NFV initiatives

4.24.1.1 Open Networking Switches

4.24.2 Analysis

4.25 Ekinops (OneAccess Networks)

4.25.1 SDN and NFV initiatives

4.25.1.1 Ekinops OVP

4.25.2 Analysis

4.26 Enea

4.26.1 SDN and NFV initiatives

4.26.1.1 Enea NFV Core and Enea NFV Access

4.26.1.2 Enea Qosmos NFV Probe

4.26.2 Analysis

4.27 Ericsson

4.27.1 SDN and NFV initiatives

4.27.1.1 Ericsson Cloud SDN

4.27.1.2 Ericsson Services SDN

4.27.1.3 Ericsson Virtual Router

4.27.1.4 Ericsson MANO

4.27.1.5 Ericsson NFVi Solution

4.27.2 Analysis

4.28 ETSI

4.29 F5 Networks

4.29.1 SDN and NFV initiatives

4.29.1.1 Big IP VNF portfolio

4.29.2 Analysis

4.30 Fortinet

4.30.1 SDN and NFV initiatives

4.30.1.1 FortiGate VM

4.30.1.2 FortiGate VMX

4.30.2 Analysis

4.31 HPE

4.31.1 SDN and NFV initiatives

4.31.1.1 HPE Carrier SDN

4.31.1.2 NFV System

4.31.1.3 Service Director

4.31.2 Analysis

4.32 Huawei

4.32.1 SDN and NFV initiatives

4.32.1.1 Agile Controller

4.32.1.2 Huawei CE 1800 Virtual Switch

4.32.1.3 Huawei USG6000V Virtual Service Gateway

4.32.1.4 FusionSphere

4.32.2 Analysis

4.33 Infinera

4.33.1 SDN and NFV initiatives

4.33.1.1 Xceed Software Suite

4.33.2 Analysis

4.34 Inocybe

4.34.1 SDN and NFV initiatives

4.34.1.1 Open Networking Platform (ONP)

4.34.2 Analysis

4.35 Infoblox

4.35.1 SDN and NFV initiatives

4.35.1.1 Infoblox Virtual Secure DNS

4.35.2 Analysis

4.36 Intel

4.36.1 SDN and NFV initiatives

4.36.1.1 Open Network Platform Server

4.36.2 Analysis

4.37 Ixia

4.37.1 SDN and NFV initiatives

4.37.1.1 IxNetwork VE

4.37.1.2 IxLoad VE for L4-L7

4.37.1.3 BreakingPoint VE

4.37.2 Analysis

4.38 Juniper

4.38.1 SDN and NFV initiatives

4.38.1.1 Contrail Networking

4.38.1.2 Contrail Cloud

4.38.1.3 Contrail Service Orchestration

4.38.1.4 vMX Carrier grade router

4.38.1.5 vSRX Virtual integrated firewall

4.38.2 Analysis

4.39 Linux Foundation

4.39.1.1 Analysis

4.40 Lumina Networks Inc.

4.40.1 SDN and NFV initiatives

4.40.1.1 Lumina SDN Controller

4.40.1.2 Lumina VNF Manager

4.40.2 Analysis

4.41 Mushroom Networks

4.41.1 SDN and NFV initiatives

4.41.1.1 Truffle Broadband Bonding

4.41.2 Analysis

4.42 Metaswitch Networks

4.42.1 SDN and NFV initiatives

4.42.1.1 Metaswitch Perimeta SBC

4.42.1.2 Metaswitch Clearwater IMS Core

4.42.2 Analysis

4.43 NEC/Netcracker

4.43.1 SDN and NFV initiatives

4.43.1.1 SDN Controllers

4.43.1.2 NFV MANO

4.43.1.3 VNFs

4.43.1.4 Proposed VNF – Cloud RAN (C-RAN):

4.43.1.5 Other initiatives

4.43.2 Analysis

4.44 Netronome

4.44.1 SDN and NFV initiatives

4.44.1.1 Agilio SmartNICs

4.44.2 Analysis

4.45 Netrounds

4.45.1 SDN and NFV initiatives

4.45.1.1 Virtual Test Agent (VTA)

4.45.2 Analysis

4.46 NFWare

4.46.1 SDN and NFV initiatives

4.46.1.1 NFWare Virtual Carrier-grade NAT

4.46.1.2 NFWare Virtual Application Delivery Controller (ADC)

4.46.1.3 vURL-Filtering

4.46.2 Analysis

4.47 Nokia

4.47.1 SDN and NFV initiatives

4.47.1.1 Nuage Networks Virtualized Services Platform (VSP)

4.47.1.2 Airframe Data Center Solution

4.47.1.3 CloudBand:

4.47.1.4 Nokia VoLTE

4.47.2 Analysis

4.48 NoviFlow

4.48.1 SDN and NFV initiatives

4.48.1.1 NoviSwitch

4.48.1.2 NoviWare

4.48.2 Analysis

4.49 Oracle

4.49.1 SDN and NFV initiatives

4.49.1.1 Communications Network Service Orchestration Solution

4.49.1.2 Agile IMS Infrastructure for Service Delivery

4.49.2 Analysis

4.50 Pluribus

4.50.1 SDN and NFV initiatives

4.50.1.1 Open Netvisor Linux

4.50.1.2 Adaptive Cloud Fabric

4.50.2 Analysis

4.51 QualiSystems

4.51.1 SDN and NFV initiatives

4.51.1.1 CloudShell

4.51.2 Analysis

4.52 RAD

4.52.1 SDN and NFV initiatives

4.52.1.1 vCPE Toolbox

4.52.2 Analysis

4.53 Radisys

4.53.1 SDN and NFV initiatives

4.53.1.1 Cloud-based NFVi

4.53.1.2 MediaEngine

4.53.2 Analysis

4.54 Red Hat

4.54.1 SDN and NFV initiatives

4.54.1.1 Red Hat OpenStack

4.54.2 Analysis

4.55 Ribbon Communications

4.55.1 SDN and NFV initiatives

4.55.1.1 Sonus VellOS

4.55.1.2 Sonus SBC Software Lite Edition

4.55.1.3 Genband VNF Manager

4.55.1.4 Genband VNFs

4.55.2 Analysis

4.56 Samsung

4.56.1 SDN and NFV initiatives

4.56.1.1 Samsung AdaptiV

4.56.2 Analysis

4.57 Spirent

4.57.1 SDN and NFV initiatives

4.57.1.1 TestCenter Virtual

4.57.2 Analysis

4.58 Telco Systems:

4.58.1 SDN and NFV initiatives

4.58.1.1 Cloud Metro

4.58.1.2 NFVTime

4.58.2 Analysis

4.59 Versa Networks

4.59.1 SDN and NFV initiatives

4.59.1.1 Versa SD-WAN Portfolio

4.59.2 Analysis

4.60 Veryx Technologies

4.60.1 SDN and NFV initiatives

4.60.1.1 SAMTEST

4.60.1.2 vTAP

4.60.1.3 FlowAnalyzer

4.60.1.4 PktBlaster

4.60.2 Analysis

4.61 VMware

4.61.1 SDN and NFV initiatives

4.61.2 Analysis

4.62 Wind River

4.62.1 SDN and NFV initiatives

4.62.1.1 Titanium Cloud Product Portfolio

4.62.2 Analysis

5 Telco Profiles

5.1 Overview of telco approaches

5.2 Telco profiles

5.3 Airtel

5.3.1 SDN and NFV initiatives

5.3.2 Analysis

5.4 AT&T

5.4.1 SDN and NFV initiatives

5.4.2 Analysis

5.5 BT

5.5.1 SDN and NFV initiatives

5.5.2 Analysis

5.6 CenturyLink

5.6.1 SDN and NFV initiatives

5.6.2 Analysis

5.7 China Mobile

5.7.1 SDN and NFV initiatives

5.7.2 Analysis

5.8 China Telecom

5.8.1 SDN and NFV initiatives

5.8.2 Analysis

5.9 China Unicom

5.9.1 SDN and NFV initiatives

5.9.2 Analysis

5.10 Deutsche Telekom

5.10.1 SDN and NFV initiatives

5.10.2 Analysis

5.11 Etisalat

5.11.1 SDN and NFV initiatives

5.11.2 Analysis

5.12 Frontier Communications

5.12.1 SDN and NFV initiatives

5.12.2 Analysis

5.13 Jio

5.13.1 SDN and NFV initiatives

5.13.2 Analysis

5.14 KDDI

5.14.1 SDN and NFV initiatives

5.14.2 Analysis

5.15 KT

5.15.1 SDN and NFV initiatives

5.15.2 Analysis

5.16 LG Uplus

5.16.1 SDN and NFV initiatives

5.16.2 Analysis

5.17 NTT Docomo

5.17.1 SDN and NFV initiatives

5.17.2 Analysis

5.18 Ooredoo

5.18.1 SDN and NFV initiatives

5.18.2 Analysis

5.19 Optus

5.19.1 SDN and NFV initiatives

5.19.2 SDN and NFV initiatives

5.19.3 Analysis

5.20 Orange

5.20.1 SDN and NFV initiatives

5.20.2 Analysis

5.21 Saudi Telecom

5.21.1 SDN and NFV initiatives

5.21.2 Analysis

5.22 Singtel

5.22.1 SDN and NFV initiatives

5.22.2 Analysis

5.23 SK Telecom

5.23.1 SDN and NFV initiatives

5.23.2 Analysis

5.24 Softbank

5.24.1 SDN and NFV initiatives

5.24.2 Analysis

5.25 Swisscom

5.25.1 SDN and NFV initiatives

5.25.2 Analysis

5.26 Telecom Italia

5.26.1 SDN and NFV initiatives

5.26.2 Analysis

5.27 Telefonica

5.27.1 SDN and NFV initiatives

5.27.2 Analysis

5.28 Telia

5.28.1 SDN and NFV initiatives

5.28.2 Analysis

5.29 Telkom Indonesia

5.29.1 SDN and NFV initiatives

5.29.2 Analysis

5.30 Telstra

5.30.1 SDN and NFV initiatives

5.30.2 Analysis

5.31 Turk Telecom

5.31.1 SDN and NFV initiatives

5.31.2 Analysis

5.32 Turkcell

5.32.1 SDN and NFV initiatives

5.32.2 Analysis

5.33 Veon VimpelCom

5.33.1 SDN and NFV initiatives

5.33.2 Analysis

5.34 Vodafone

5.34.1 SDN and NFV initiatives

5.34.2 Analysis

5.35 Verizon

5.35.1 SDN and NFV initiatives

5.35.2 Analysis

5.36 Sprint Corporation

5.36.1 SDN and NFV initiatives

5.36.2 Analysis

6 Quantitative Forecasts

6.1 Research Methodology

6.2 Introduction to forecast taxonomy

6.2.1 SDN forecast taxonomy and rationale

6.2.2 NFV forecast taxonomy and rationale

6.3 User segments

6.3.1 Service providers

6.3.2 Enterprises and others

6.4 Regional markets

6.4.1 North America

6.4.2 Europe, Middle-East and Africa

6.4.3 Asia-Pacific

6.4.4 Caribbean and Latin America

6.5 The SDN market

6.5.1 Overview

6.5.2 Solution components

6.5.2.1 Control hardware

6.5.2.2 Software

6.5.2.3 End-device hardware

6.5.3 CORD

6.5.3.1 Definitions and assumptions

6.5.3.2 Breakdown by solution components

6.5.3.3 Breakdown by user segments

6.5.3.4 Breakdown by regional markets

6.5.4 Service Function Chaining

6.5.4.1 Definitions and assumptions

6.5.4.2 Breakdown by solution components

6.5.4.3 Breakdown by user segments

6.5.4.4 Breakdown by regional markets

6.5.5 SD-WAN

6.5.5.1 Definitions and assumptions

6.5.5.2 Breakdown by solution components

6.5.5.3 Breakdown by user segments

6.5.5.4 Breakdown by regional markets

6.5.6 NaaS/BoD

6.5.6.1 Definitions and assumptions

6.5.6.2 Breakdown by solution components

6.5.6.3 Breakdown by user segments

6.5.6.4 Breakdown by regional markets

6.5.7 Network Slicing

6.5.7.1 Definitions and assumptions

6.5.7.2 Breakdown by solution components

6.5.7.3 Breakdown by user segments

6.5.7.4 Breakdown by regional markets

6.5.8 Service Delivery and Fulfillment

6.5.8.1 Definitions and assumptions

6.5.8.2 Breakdown by solution components

6.5.8.3 Breakdown by user segments

6.5.8.4 Breakdown by regional markets

6.6 The NFV market

6.6.1 Overview

6.6.2 Solution components

6.6.2.1 MANO

6.6.2.2 NFVi

6.6.3 vLB, vADC, vWOC

6.6.3.1 Definitions and assumptions

6.6.3.2 Breakdown by solution components

6.6.3.3 Breakdown by user segments

6.6.3.4 Breakdown by regional markets

6.6.4 vRouter, vCGNAT

6.6.4.1 Definitions and assumptions

6.6.4.2 Breakdown by solution components

6.6.4.3 Breakdown by user segments

6.6.4.4 Breakdown by regional markets

6.6.5 vSwitch

6.6.5.1 Definitions and assumptions

6.6.5.2 Breakdown by solution components

6.6.5.3 Breakdown by user segments

6.6.5.4 Breakdown by regional markets

6.6.6 vIMS, vCSC, vPCRF

6.6.6.1 Definitions and assumptions

6.6.6.2 Breakdown by solution components

6.6.6.3 Breakdown by user segments

6.6.6.4 Breakdown by regional markets

6.6.7 vBBU, vRAN, xRAN

6.6.7.1 Definitions and assumptions

6.6.7.2 Breakdown by solution components

6.6.7.3 Breakdown by user segments

6.6.7.4 Breakdown by regional markets

6.6.8 vEPC, vVoLTE

6.6.8.1 Definitions and assumptions

6.6.8.2 Breakdown by solution components

6.6.8.3 Breakdown by user segments

6.6.8.4 Breakdown by regional markets

6.6.9 vAMS, vSBC, vWebRTC GW

6.6.9.1 Definitions and assumptions

6.6.9.2 Breakdown by solution components

6.6.9.3 Breakdown by user segments

6.6.9.4 Breakdown by regional markets

6.6.10 vCPE, vSG

6.6.10.1 Definitions and assumptions

6.6.10.2 Breakdown by solution components

6.6.10.3 Breakdown by user segments

6.6.10.4 Breakdown by regional markets

6.6.11 vWAG

6.6.11.1 Definitions and assumptions

6.6.11.2 Breakdown by solution components

6.6.11.3 Breakdown by user segments

6.6.11.4 Breakdown by regional markets

6.6.12 vDNS

6.6.12.1 Definitions and assumptions

6.6.12.2 Breakdown by solution components

6.6.12.3 Breakdown by user segments

6.6.12.4 Breakdown by regional markets

6.6.13 vFirewall

6.6.13.1 Definitions and assumptions

6.6.13.2 Breakdown by solution components

6.6.13.3 Breakdown by user segments

6.6.13.4 Breakdown by regional markets

6.6.14 vIPSec, vVPN

6.6.14.1 Definitions and assumptions

6.6.14.2 Breakdown by solution components

6.6.14.3 Breakdown by user segments

6.6.14.4 Breakdown by regional markets

6.6.15 vIM

6.6.15.1 Definitions and assumptions

6.6.15.2 Breakdown by solution components

6.6.15.3 Breakdown by user segments

6.6.15.4 Breakdown by regional markets

6.6.16 vVoIP

6.6.16.1 Definitions and assumptions

6.6.16.2 Breakdown by solution components

6.6.16.3 Breakdown by user segments

6.6.16.4 Breakdown by regional markets

6.6.17 vProbe, vTA

6.6.17.1 Definitions and assumptions

6.6.17.2 Breakdown by solution components

6.6.17.3 Breakdown by user segments

6.6.17.4 Breakdown by regional markets

7. Glossary and Acronyms

List for Tables:

Table:1-1 Global market for SDN and NFV ($ million); 2017-2023

Table:6-1 Global market for SDN; by solution component ($ million); 2017-2023

Table:6-2 Global market for BFV; by solution component ($ million); 2017-2023

Table:6-3 Global market for SDN and NFV; by user segment ($ million); 2017-2023

Table:6-4 Global market for SDN and NFV; by regional market ($ million); 2017-2023

Table:6-5 Global market for SDN contol hardware; by use-case ($ million); 2017-2023

Table:6-6 Global market for SDN software; by use-case ($ million); 2017-2023

Table:6-7 Global market for SDN end-device hardware; by use-case ($ million); 2017-2023

Table:6-8 Global market for CORD use-case; by solution component ($ million); 2017-2023

Table:6-9 Global market for CORD use-case; by user segment ($ million); 2017-2023

Table:6-10 Global market for CORD use-case; by regional market ($ million); 2017-2023

Table:6-11 Global market for service function chaining use-case; by solution component ($ million); 2017-2023

Table:6-12 Global market for service function chaining use-case; by user segment ($ million); 2017-2023

Table:6-13 Global market for service function chaining use-case; by regional market ($ million); 2017-2023

Table:6-14 Global market for SD-WAN use-case; by solution component ($ million); 2017-2023

Table:6-15 Global market for SD-WAN use-case; by user segment ($ million); 2017-2023

Table:6-16 Global market for SD-WAN use-case; by regional market ($ million); 2017-2023

Table:6-17 Global market for NaaS/BoD use-case; by solution component ($ million); 2017-2023

Table:6-18 Global market for NaaS/BoD use-case; by user segment ($ million); 2017-2023

Table:6-19 Global market for NaaS/BoD use-case; by regional market ($ million); 2017-2023

Table:6-20 Global market for network slicing use-case; by solution component ($ million); 2017-2023

Table:6-21 Global market for network slicing use-case; by user segment ($ million); 2017-2023

Table:6-22 Global market for network slicing use-case; by regional market ($ million); 2017-2023

Table:6-23 Global market for service delivery and fulfillment use-case; by solution component ($ million); 2017-2023

Table:6-24 Global market for service delivery and fulfillment use-case; by user segment ($ million); 2017-2023

Table:6-25 Global market for service delivery and fulfillment use-case; by regional market ($ million); 2017-2023

Table:6-26 Global market for MANO; by VNF use-case category ($ million); 2017-2023

Table:6-27 Global market for NFVi; by VNF use-case category ($ million); 2017-2023

Table:6-28 Global market for vLB, vADC, vWOC VNFs; by solution component ($ million); 2017-2023

Table:6-29 Global market for vLB, vADC, vWOC VNFs; by user segment ($ million); 2017-2023

Table:6-30 Global market for vLB, vADC, vWOC VNFs; by regional market ($ million); 2017-2023

Table:6-31 Global market for vRouter, vCGNAT VNFs; by solution component ($ million); 2017-2023

Table:6-32 Global market for vRouter, vCGNAT VNFs; by user segment ($ million); 2017-2023

Table:6-33 Global market for vRouter, vCGNAT VNFs; by regional market ($ million); 2017-2023

Table:6-34 Global market for vSwitch VNF; by solution component ($ million); 2017-2023

Table:6-35 Global market for vSwitch VNF; by user segment ($ million); 2017-2023

Table:6-36 Global market for vSwitch VNF; by regional market ($ million); 2017-2023

Table:6-37 Global market for vIMS, vCSC, vPCRF VNFs; by solution component ($ million); 2017-2023

Table:6-38 Global market for vIMS, vCSC, vPCRF VNFs; by user segment ($ million); 2017-2023

Table:6-39 Global market for vIMS, vCSC, vPCRF VNFs; by regional market ($ million); 2017-2023

Table:6-40 Global market for vBBU, vRAN, xRAN VNFs; by solution component ($ million); 2017-2023

Table:6-41 Global market for vBBU, vRAN, xRAN VNFs; by user segment ($ million); 2017-2023

Table:6-42 Global market for vBBU, vRAN, xRAN VNFs; by regional market ($ million); 2017-2023

Table:6-43 Global market for vEPC, vVoLTE VNFs; by solution component ($ million); 2017-2023

Table:6-44 Global market for vEPC, vVoLTE VNFs; by user segment ($ million); 2017-2023

Table:6-45 Global market for vEPC, vVoLTE VNFs; by regional market ($ million); 2017-2023

Table:6-46 Global market for vAMS, vSBC, vWebRTC GW VNFs; by solution component ($ million); 2017-2023

Table:6-47 Global market for vAMS, vSBC, vWebRTC GW VNFs; by user segment ($ million); 2017-2023

Table:6-48 Global market for vAMS, vSBC, vWebRTC GW VNFs; by regional market ($ million); 2017-2023

Table:6-49 Global market for vCPE, vSG VNFs; by solution component ($ million); 2017-2023

Table:6-50 Global market for vCPE, vSG VNFs; by user segment ($ million); 2017-2023

Table:6-51 Global market for vCPE, vSG VNFs; by regional market ($ million); 2017-2023

Table:6-52 Global market for vWAG VNF; by solution component ($ million); 2017-2023

Table:6-53 Global market for vWAG VNF; by user segment ($ million); 2017-2023

Table:6-54 Global market for vWAG VNF; by regional market ($ million); 2017-2023

Table:6-55 Global market for vDNS VNF; by solution component ($ million); 2017-2023

Table:6-56 Global market for vDNS VNF; by user segment ($ million); 2017-2023

Table:6-57 Global market for vDNS VNF; by regional market ($ million); 2017-2023

Table:6-58 Global market for vFirewall VNF; by solution component ($ million); 2017-2023

Table:6-59 Global market for vFirewall VNF; by user segment ($ million); 2017-2023

Table:6-60 Global market for vFirewall VNF; by regional market ($ million); 2017-2023

Table:6-61 Global market for vIPSec, vVPN VNFs; by solution component ($ million); 2017-2023

Table:6-62 Global market for vIPSec, vVPN VNFs; by user segment ($ million); 2017-2023

Table:6-63 Global market for vIPSec, vVPN VNFs; by regional market ($ million); 2017-2023

Table:6-64 Global market for vIM VNF; by solution component ($ million); 2017-2023

Table:6-65 Global market for vIM VNF; by user segment ($ million); 2017-2023

Table:6-66 Global market for vIM VNF; by regional market ($ million); 2017-2023

Table:6-67 Global market for vVoIP VNF; by solution component ($ million); 2017-2023

Table:6-68 Global market for vVoIP VNF; by user segment ($ million); 2017-2023

Table:6-69 Global market for vVoIP VNF; by regional market ($ million); 2017-2023

Table:6-70 Global market for vProbe, vTA VNFs; by solution component ($ million); 2017-2023

Table:6-71 Global market for vProbe, vTA VNFs; by user segment ($ million); 2017-2023

Table:6-72 Global market for vProbe, vTA VNFs; by regional market ($ million); 2017-2023

List for Figures:

Figure 1-1: VNF categories and types

Figure 1-2: Market share of SDN and NFV technologies, by technology

Figure 1-3: Telco cloud and networking services

Figure 2-1: SDN Architecture

Figure 2-2: OpenContrail Architecture

Figure 2-3: Interfaces to SDN controller

Figure 2-4: Components of Ensemble family of product

Figure 3-1: Comparing ECOMP and ETSI MANO

Figure 4-1: 6WIND Telco cloud and networking services

Figure 4-2: Amdocs NFV partner ecosystem

Figure 4-3: Components of Cisco NFVI

Figure 4-4: Cisco ACI Architecture

Figure 4-5: Components of Cumulus Linux operating system and their functions

Figure 4-6: High-level architecture of Ericsson SDN products and solutions

Figure 4-7: Service chaining flow in Service SDN

Figure 6-1: SDN technology market forecast taxonomy

Figure 6-2: Market share of SDN technology, by solution component

Figure 6-3: NFV technology market forecast taxonomy

Figure 6-4: Market share of NFV technology, by solution component

Figure 6-5: Market share of SDN and NFV technologies, by user segment

Figure 6-6: Market share of SDN and NFV technologies, by geographical region

Figure 6-7: Global market for SDN technologies, by use-case

Figure 6-8: Market share of SDN Control Hardware, by use-case

Figure 6-9: Market share of SDN Software, by use-case

Figure 6-10: Market share of SDN End-Device Hardware, by use-case

Figure 6-11: Market share of CORD use-case, by solution component

Figure 6-12: Market share of Service Function Chaining use-case, by solution component

Figure 6-13: Market share of SD-WAN use-case, by solution component

Figure 6-14: Market share of NaaS/BoD use-case, by solution component

Figure 6-15: Market share of Network Slicing use-case, by solution component

Figure 6-16: Market share of Service Delivery and Fulfilment use-case, by solution component

Figure 6-17: Global market for NFV technologies, by use-case

Figure 6-18: Market share of MANO, by VNF use-case category

Figure 6-19: Market share of NFVi, by VNF use-case category

Figure 6-20: Market share of vLB, vADC, vWOC VNFs, by solution component

Figure 6-21: Market share of vRouter, vCGNAT VNFs, by solution component

Figure 6-22: Market share of vSwitch VNF, by solution component

Figure 6-23: Market share of vIMS, vCSC, vPCRF VNFs, by solution component

Figure 6-24: Market share of vBBU, vRAN, xRAN VNFs, by solution component

Figure 6-25: Market share of vEPC, vVoLTE VNFs, by solution component

Figure 6-26: Market share of vAMS, vSBC, vWebRTC GW VNFs, by solution component

Figure 6-27: Market share of vCPE, vSG VNFs, by solution component

Figure 6-28: Market share of vWAG VNF, by solution component

Figure 6-29: Market share of vDNS VNF, by solution component

Figure 6-30: Market share of vFirewall VNF, by solution component

Figure 6-31: Market share of vIPSec, vVPN VNFs, by solution component

Figure 6-32: Market share of vIM VNF, by solution component

Figure 6-33: Market share of vVoIP VNF, by solution component

Figure 6-34: Market share of vProbe, vTA VNFs, by solution component